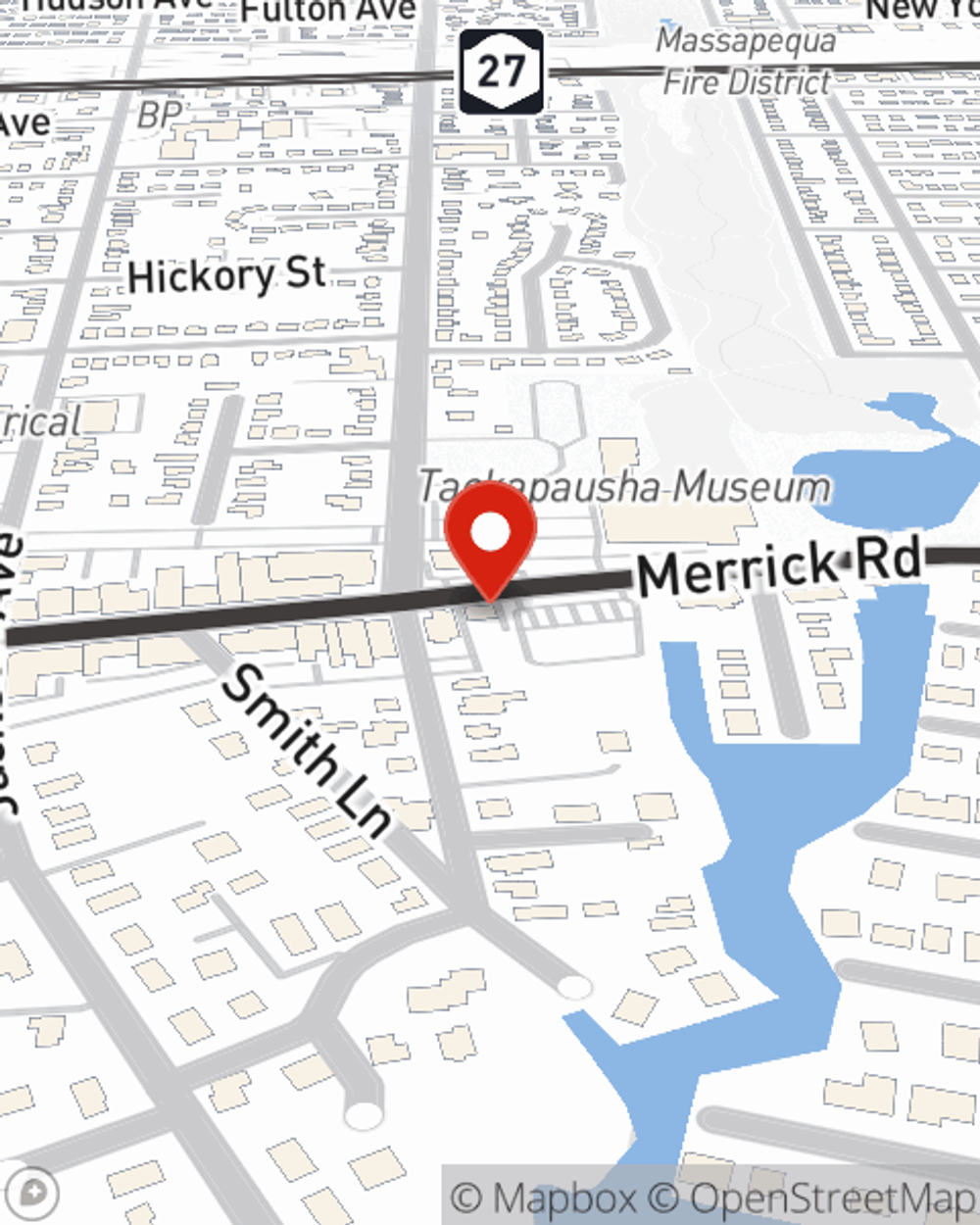

Business Insurance in and around Seaford

One of the top small business insurance companies in Seaford, and beyond.

This small business insurance is not risky

This Coverage Is Worth It.

Do you own a veterinarian, a clock shop or a home cleaning service? You're in the right place! Finding the right insurance for you shouldn't be risky business so you can focus on making this adventure a success.

One of the top small business insurance companies in Seaford, and beyond.

This small business insurance is not risky

Customizable Coverage For Your Business

When one is as enthusiastic about their small business as you are, it makes sense to want to make sure everything has been thought of. That's why State Farm has coverage options for worker’s compensation, artisan and service contractors, business owners policies, and more.

The right coverages can help keep your business safe. Consider visiting State Farm agent Victoria Van De Ven's office today to identify your options and get started!

Simple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Victoria Van De Ven

State Farm® Insurance AgentSimple Insights®

Writing a rental agreement or lease

Writing a rental agreement or lease

When creating a lease there are some typical and optional items to include. Find out more in this article.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.